Creating Resilience

The Case for ESG Adoption

August 20, 2021 10 Minute Read

Looking for a PDF of this content?

At a conference 10 years ago, when asked if the economic case had been made for “green” buildings, not a single commercial real estate investor raised their hand. At similar events today when asked the same question, nearly every hand goes up. “Green” is now considered table stakes for most institutional investors globally, but it’s not unanimous.

Indeed, there is increasing pressure on building owners and investors to meet Environmental, Social and Governance (ESG) goals, which are not easy to justify in standard return-on-investment appraisals. Nevertheless, they are becoming increasingly important to protect and even enhance ROI because of their demand from prospective buyers and tenants.

There are several organizations that help guide sustainable development and investment at both the macro level (U.N. Principles of Responsible Investing) and at the micro or asset level (Green Building Adoption Council, LEED, Energy Star and WELL). So why not just follow the rules laid out by these organizations for all commercial real estate investment and asset management decisions? The reason most often cited is because it doesn’t always make economic sense.

Most institutional investors say it is their fiduciary duty to justify a green investment by providing a return comparable to that of a non-green investment. Nevertheless, it is equally important for investors to stay in front of societal expectations for sustainable development, particularly when those expectations are evolving as quickly as they are today.

Institutional investors can choose to put their money in “impact funds” that directly target ESG goals. Some are already doing this, such as Oxford Properties of Canada. Oxford CEO Michael Turner says that while the company has only a small investment in an impact fund, “in the medium to long term, all investments will be expected to produce positive ESG outcomes.”

According to CBRE’s Chief Responsibility Officer Tim Dismond, “ESG considerations are increasingly influencing how and where capital is being placed and how businesses are operated.” Indeed, changing investor expectations and anticipated regulatory changes are making ESG considerations more urgent, even while investors are challenged to generate strong returns.

Indeed, changing investor expectations and anticipated regulatory changes are making ESG considerations more urgent, even while investors are challenged to generate strong returns.

While data to make the investment case for green is scarce in some situations, evidence suggests that a case can be made for office and certain other assets, particularly in markets with strict environmental regulations. We are increasingly seeing investors, particularly those from Europe, demand that retail and industrial assets follow green compliance standards applied to the office sector. In this case, going green is as much a defensive play (anticipating future changes that could devalue an asset) as an offensive play (doing it today in the hope of better returns tomorrow).

More hard data on ROI associated with ESG will be key to broad adoption. But now is the time to get ahead of the ESG wave by pricing out the cost of compliance with ESG standards and adopting those that make the strongest ROI case to attract tenants and potential buyers.

Why Now?

As stated by Sonny Kalsi, CEO of Bentall GreenOak, a large commercial real estate institutional investor, “Mother Nature has been angry at us.” This is evident from the recent Texas deep freeze that knocked out power throughout the state, to wildfires that have raged from California to Australia, to droughts in many parts of the world and increasingly active hurricane seasons. As a result, the mindset of institutional investors has squarely shifted: Commercial buildings—one of the largest producers of carbon emissions—must be part of the solution.

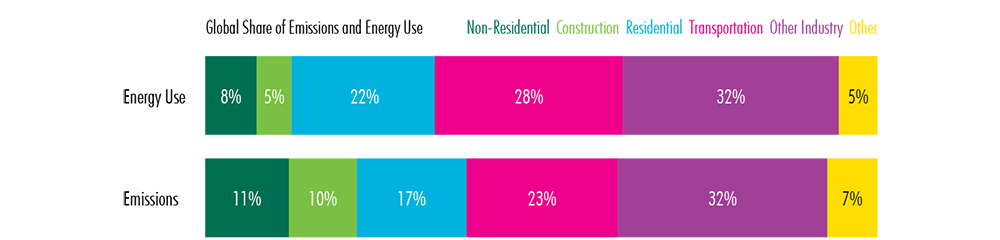

Figure 1: The Construction Industry and Non-Residential Sector Account for 13% of Energy Use, But 21% of Emissions

Source: International Energy Agency, Global Alliance for Buildings and Construction, CBRE Research.

Invesco has taken an innovative approach to addressing climate change by including “resilience” to natural disasters in their ESG approach to commercial real estate investment. According to Invesco’s Michael Kirby, who is leading this initiative, “Today we’re spending more and more time on climate risk resilience, particularly with our investors.”

A Defensive Approach

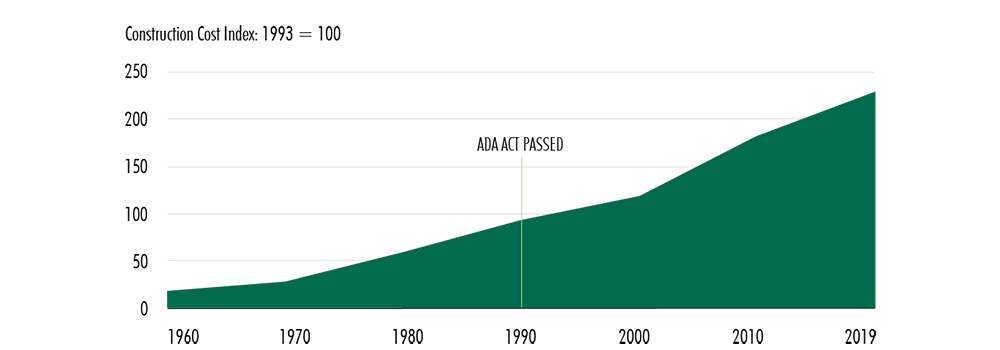

Chuck Leitner, CEO of CBRE Global Investors, sees ESG as much a defensive play as an offensive one. “Remember when you had to put a food court in a mall, otherwise the mall would become obsolete? You didn’t get a return on that food court, but if you didn’t have one nobody showed up to shop. At some point, if your building is not resilient to natural disasters, people just aren’t going to show up. So, some of the return on investment is more defensive than offensive.” Defense includes protection against the risk of changes in law, such as what happened in 1990 with implementation of the Americans With Disabilities Act, which materially increased the costs of renovating commercial real estate.

Figure 2: The Americans With Disabilities Act Had Little Impact On New Construction Costs, But Implications On Renovations Are Significant

Source: RSMeans, CBRE Research.

Defense also takes the form of bypassing certain asset types or disfavored industries, such as German investor Deka’s decision in 2020 to exclude its funds from investing in any company that generates at least 30% of its sales from coal production or 40% from coal-fired power generation.

In the U.K. and Continental Europe, a “brown discount” is becoming more commonplace in sales negotiations. For example, the sales price could be discounted by the amount needed to bring an asset up to current or anticipated regulatory standards. That is why it is important to measure the cost of compliance today so that a seller is not surprised at the time of the sale.

Resilience

Resilience is a subcategory of Environmental criteria that some investors, notably Invesco, have emphasized. It includes ensuring that buildings are safe from flooding, hurricanes or other natural disasters depending on the location.

The resilience factor came to the fore in response to Hurricane Sandy in 2012. Several state and local laws were enacted to help make structures more resilient. An example was an amendment to the New Jersey Flood Hazard Control Act, changing height requirements for critical infrastructure in buildings located in 100-year flood plains.

Social Responsibility

Recent social unrest has had material impact on the way the business world looks at social responsibility. The Business Roundtable—an association of major U.S. corporations—was ahead of this issue when it issued a statement on “the purpose of a corporation.” In it, Business Roundtable members committed “to lead their companies for the benefit of all stakeholders—customers, employees, suppliers, communities and shareholders…The free-market system is the best means of generating good jobs, a strong and sustainable economy, innovation, a healthy environment and economic opportunity for all.”

Institutional investors are largely addressing social concerns through hiring. For example, Bentall Green Oak has declared that at least two-thirds of all future hires will be women and minorities. CEO Sonny Kalsi says Bentall Green’s approach is to “take something that is really, really well intentioned and make it measurable and really hold our feet to the fire.”

On a broader scale, the Tax Cuts and Jobs Act of 2017 facilitated the creation of Opportunity Zones, a program intended to help promote development in communities that need economic assistance. While the program’s intent was noble, the results have been mixed and highlight the complicated role public policy plays in fostering goals that benefit society. The public/private partnership approach is advocated by Invesco’s Scott Dennis: “We’ve had some luck on affordable housing where we’ve taken a conventional property, gone to the municipality and offered to proactively convert some of the units in multifamily to affordable housing in exchange for a tax abatement. It is a process though as governments don’t work like the private sector, so there’s an element of risk you’ve got to evaluate, but I think there are ways to do it.”

Commercial real estate investors are required to achieve the same returns in economically disadvantaged communities as in other locations. Public/private partnerships are the key to bridging this gap.

Wellness

Wellness is being emphasized more than any other ESG criterion due to COVID-19. While short-term wellness enhancements include enhanced janitorial services and social distancing, the question is what will be the permanent wellness changes from COVID-19. “Well” certifications for buildings are based on 10 criteria:

Source: WELL Building Standard

Among the changes we expect are more innovation in indoor air quality, both through modifying existing HVAC forced-air systems and installing new hydronic HVAC systems that heat and cool buildings with water. More touchless technology in elevators and other common areas will further safety and wellness. Like environmental upgrades, significant capex is required to make some of these changes, especially overhauls to HVAC systems. Wellness likely will become “table stakes” to attract tenants.

Conflicts Among ESG Factors

While ESG factors generally are harmonious, there are emerging areas of conflict among them. One will be a push to shift some of the attention and resources away from environmental factors and toward addressing racial inequality and other social issues. Another area of conflict will be between energy efficiency and clean air, as more tenants will want outside air in their spaces through operable windows and outdoor spaces. Many developers are getting ahead of this by installing HVAC systems that bring in more outside air. Other upgrades may include the replacement of commonplace manual revolving entry doors with automatic ones to satisfy tenant demands for touchless technology.

Ongoing Measurements, Not One-Off Ratings

Perhaps the gold standard of green measurement for the past two decades is LEED, which has been instrumental in the promotion of green construction. LEED is a point-in-time measurement, whereas many institutional investors are moving toward periodic performance assessments that provide critical data to gauge environmental effectiveness.

Invesco’s Scott Dennis explains, “Investors are more interested in ongoing measurement of the asset’s environmental impact, not a point-in-time certification award in the form of a plaque. This is where the industry is headed.” Measurability over an extended time, rather than the single-point-in-time approach of LEED certification, is the key to the future of green adoption. To that end, most large institutional investors are members of the U.N. Principles for Responsible Investing (PRI), which set specific goals for energy, water and waste management, and aim for their assets to achieve zero-carbon by 2035, 2050 or another specific date.

As more institutional investors consider establishing reduced carbon or zero-carbon goals, they are increasingly looking beyond the physical building and at what materials are used in construction.

As more institutional investors consider establishing reduced carbon or zero-carbon goals, they are increasingly looking beyond the physical building and at what materials are used in construction. The use of green building materials and tracking where they are sourced will be an important consideration for both the “holistic” carbon footprint of office buildings and their ability to attract and retain tenants.

One area of interest in green construction is the use of wood, rather than steel, for framing low- to mid-rise buildings. The city of Portland has issued permits for a 12-story tower constructed with treated lumber, often known as “cross-laminated timber” or CLT, that maintains fire resistance comparable to steel. Given that this is a relatively new change to building techniques, the data is sparse, but anecdotal evidence indicates that using wood in a building can enhance tenant attraction and retention and justify higher rents.

According to Steve Luthman, Senior Managing Director for Hines, which has built numerous large office projects using mass timber, “I've never once been on a tour of any of these buildings with anyone who hasn't physically touched the timber columns. And that's a really interesting phenomenon. When you think about how people typically don’t engage physically or emotionally with office buildings, with these timber buildings they actually touch and smell them. It is a very different level of customer engagement with the built environment.”

According to Invesco’s Scott Dennis, “Our mid-rise timber building in Atlanta—Atlantic Station near Georgia Tech—was very well received by the market. We were testing the feasibility and marketability of such a project and it has paid off so far.”

Location Concerns

The location of buildings in environmentally risky zones raises questions about how investors can protect their investment. Depending on where the building is located, it may be subject to greater federal insurance scrutiny and, in extreme cases like the Outer Banks of North Carolina and parts of the Florida Keys, dwindling support from the federal government. As such, physical asset locations must be assessed in terms of environmental disaster risk, costs to mitigate such risk and whether those costs will be borne by the local community or the owners of commercial real estate in the form of property taxes, special assessments or otherwise.

Asset Types

For years, investors focused their green initiatives only on office buildings because tenants demanded it. But the world has changed and both investors and tenants are now demanding green amenities in other commercial real estate sectors, including retail and industrial. This is an opportunity for developers to get ahead of the curve and adapt their buildings to green standards today for both offensive and defensive purposes, including the adoption of solar and other alternative energy sources that not only make buildings greener but also more resilient to major weather events like the one that recently disrupted the electric grid in Texas.

The Bottom Line

ESG is growing in importance for all commercial real estate asset types, catalyzed by regulatory requirements and shifting institutional investor expectations. Developers are wise to anticipate future demand for green amenities. While the holy grail for investors is achieving a return on ESG-compliant assets that is at least equal to non-ESG-compliant assets, they should sharpen their focus on how ESG can enhance ROI in today’s world. Objective data is the key to changing the institutional investor mindset of where and what to buy and will be required for a paradigm shift in ESG compliance in commercial real estate.

“We need to put numbers on the table,” says CBRE Global Investors’ Chuck Leitner. “We need to manage this ourselves and explain how we are progressing toward certain goals. You’re just not going to be in the conversation if you don’t do that.”

Viewing your investments through both a defensive and an offensive prism to enhance or at least preserve ROI in the face of rapidly changing investor preferences for ESG compliance will pay dividends both in increased tenant demand and larger institutional bidding pools. Like any other business, commercial real estate is a for-profit industry with fiduciary responsibilities to hit returns for investors. ESG compliance increasingly must be part of that fiduciary duty.

About the Author: Spencer is Levy is CBRE’s Global Chief Client Officer and Senior Economic Advisor.

Related Insights

- Insights & Research

Future of Work

How and where business gets done has been fundamentally altered. Our latest data, insights and solutions help you understand, anticipate and influence the future of work.

.jpg)